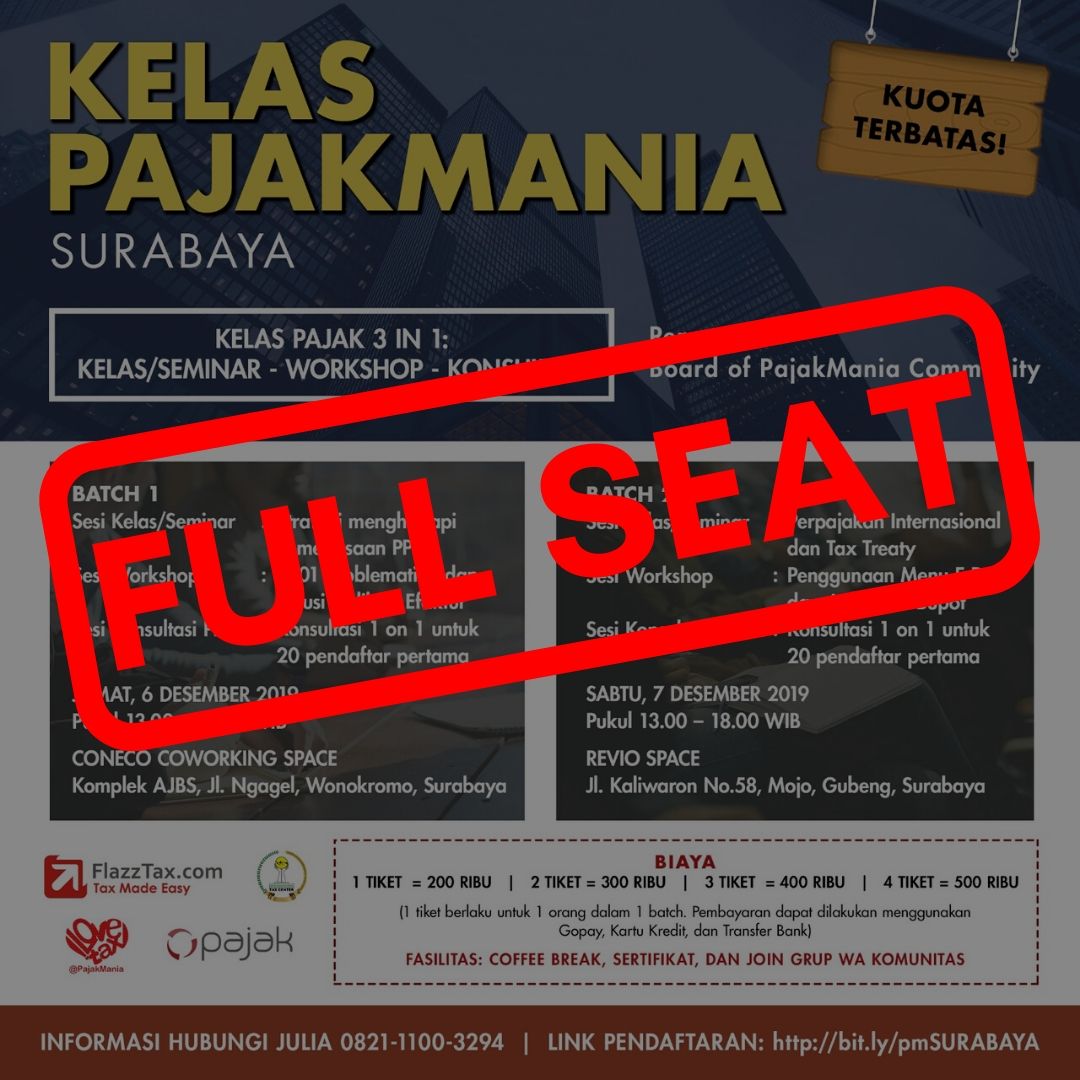

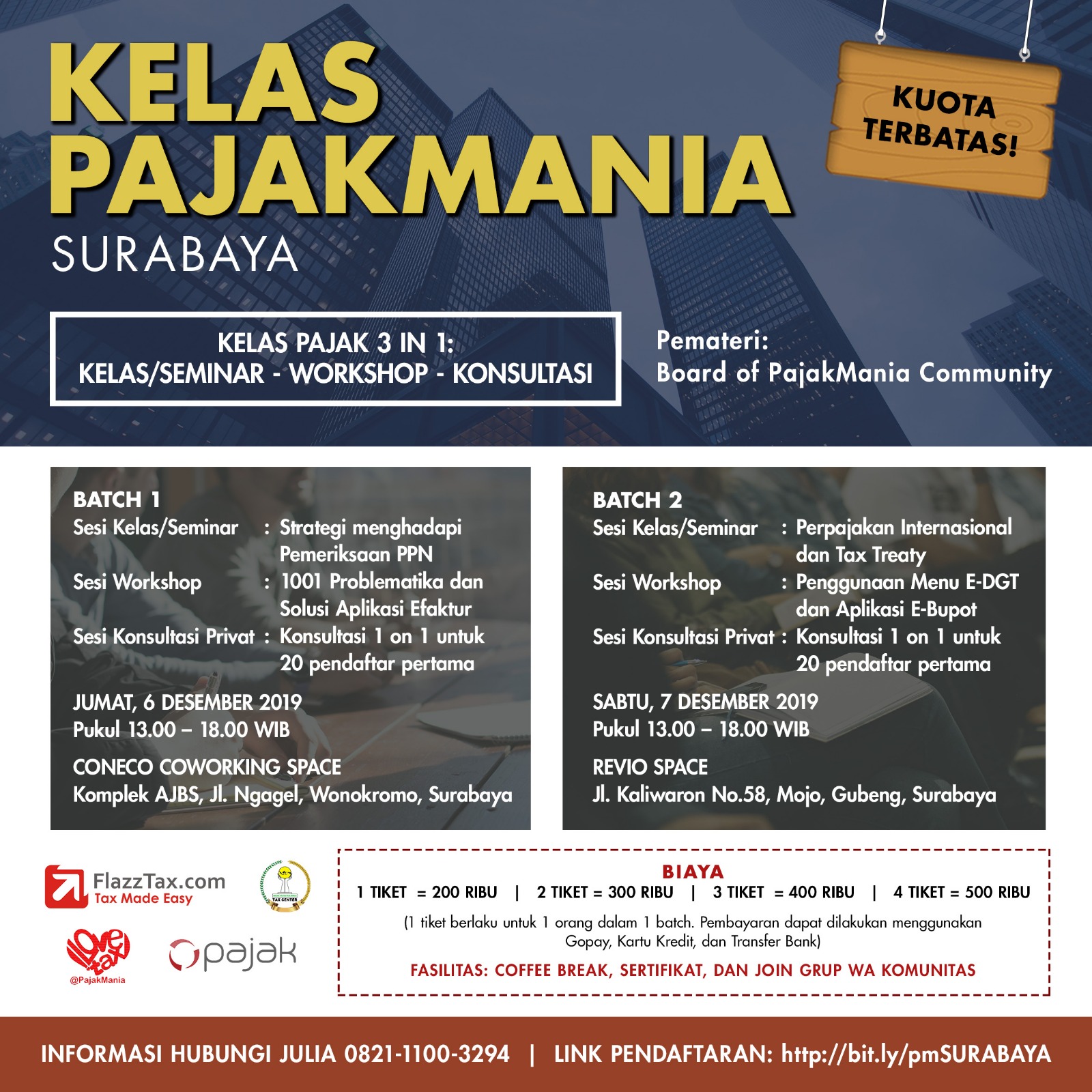

The PajakMania Class will feature a 3-in-1 concept, consisting of 3 sessions in 1 event, namely a Class/Seminar Session, a Workshop Session, and a Private Consultation Session. The PajakMania Class will be held over 2 consecutive days, covering 2 different topics.

- Discussing the topic of Strategies for Dealing with VAT Audits, followed by a Practical Workshop Session on 1001 Problems and Solutions for the Efaktur Application. The first day of the event will focus on discussing VAT from theory to technical practice, various rule updates and planning options for dealing with audits, and of course tips that can be applied in daily work.

- On Batch 2 or the second day of the event, the Class Session will be even more interesting, discussing the topics of International Taxation and Tax Treaty, followed by a Practical Workshop Session on the Use of the E-DGT Menu and E-Bupot Application. The second day of the event will focus on developments in regulations regarding the application of income tax deductions when transacting with foreign parties, from theory to technical practice, how to read Tax Treaties, and finally, updates on how the documentation is administered.

All materials will be presented by the PajakMania Community Board Team, which has more than 10 years of experience in taxation, both as consultants, teachers, practitioners, experts, and writers.

After the event is over, participants will be invited to join a WhatsApp group so that the discussion can continue.